Apply for a Covid-19 Self Isolation Support Grant

The criteria to apply for the Self Isolation Grant changed on 1st May 2022. Please check the following information carefully before proceeding.

BEFORE APPLYING PLEASE MAKE SURE YOU HAVE CONSENTED TO SHARE YOUR DATA BETWEEN TEST & PROTECT AND YOUR LOCAL AUTHORITY. YOU CAN DO THIS BY RESPONDING TO YOUR TEST & PROTECT SMS WITH YOUR POSTCODE.

A positive PCR test result will be verified with the Test & Protect Service and we will NOT be able to process your application if we cannot verify this.

In addition, prior to the period of self-isolation you must meet the following criteria:

- are employed or self-employed, and

- are unable to work from home and will experience reduced earnings as a result; and

- are assessed as having a low income, either

- your household is currently receiving, or has been awarded but not yet received a payment of the following benefits, or whose income is such that you would ordinarily be entitled to Universal Credit should an application have been made prior to their isolation:

- Universal Credit

- Working Tax Credit

- Income-based Employment and Support Allowance

- Income-based Jobseekers Allowance

- Income Support

- Housing Benefit

- Pension Credit and/or

- Means tested Council Tax Reduction, or

- your household is currently receiving, or has been awarded but not yet received a payment of the following benefits, or whose income is such that you would ordinarily be entitled to Universal Credit should an application have been made prior to their isolation:

- are an individual who earns less than the Real Living Wage threshold as detailed in the Ready Reckoner table provided by the Scottish Government for this purpose; or

- your household income is such that it falls within the agreed definition of ‘low income’ for this purpose for their household type in their local authority area, being 25% above the UC level, and including the temporary coronavirus £20 per week increase in the UC Standard Allowance. As detailed in the Ready Reckoner table provided by Scottish Government for this purpose.

We need you to provide some documents as part of your application. It is best to have these available as electronic files (you can take photo if the document is on paper) before you start the form:

- A recent bank statement

- If you are on a low income but not in receipt of benefits - you must provide your most recent payslip showing your regular wage. In some circumstances we may need proof of your partner's income.

- If you are employed – if you can, please provide confirmation from your employer that you will not be able to work from home and will have reduced earnings during the self-isolation period or following advice to stay at home. If you can upload this in the application, you will speed up the process. This can be a letter or an email.

- If you are self-employed - you must provide evidence while completing the form of self-assessment returns, trading income and proof that your business delivers services which cannot be undertaken from home.

Advice on uploads:

Files can be a maximum size of 5 MB each.

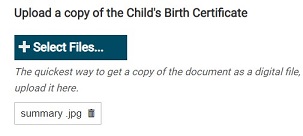

When uploading choose your file on your device and submit it. Then wait for the file to appear on the form like the image below - the file is showing as "summary.jpg".

![]()

FROM 1ST MAY 2022 YOU MUST VISIT THE SITE BELOW TO CONFIRM ELIGIBILITY AND HAVE A POSITIVE PCR TEST RESULT BEFORE COMPLETING THE APPLICATION FORM.

https://www.mygov.scot/self-isolation-grant/check-if-you-qualify-and-how-to-apply

If you are experiencing financial hardship and do not meet the criteria above and are unable to meet you daily living expenses you may be eligible and can apply for a Crisis Grant.

If you have any questions in relation to this grant, please email welfare.sisg@fife.gov.uk.

Privacy Notice

You can read the privacy notice for this application explaining what we do with your information.