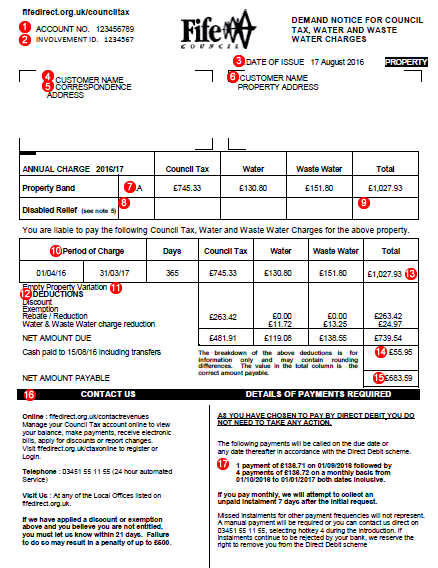

Your paper bill explained:

- Your Council Tax account number

- The involvement ID relating to your property

- The date the Council Tax bill was issued

- The person(s) liable/responsible for paying the Council Tax

- Correspondence address – where the Council Tax bill will be issued

- The property address the Council Tax bill relates to

- Band – the valuation band your property is in

- If you have had your band reduced because you have a disability, you will see your reduced band here

- The annual charge for the property shown on your bill. This is broken down into Council Tax, water & sewerage charges.

- The period of time the bill covers

- If you have a property that has been empty for 12 months or more you may be charged an empty property variation. This charge will be equivalent to your annual council tax charge.

- Any deductions that have been made to this account, up to the date the bill was issued

- Charges for your bill - broken down between Council Tax, water & waste water charges and total

- Payments that have been made to this account, up to the date the bill was issued

- This shows the balance payable for this bill

- General information along with contact details

- Payments should be made in accordance with the amounts and installment dates.

Sign up for your Council Tax Customer Online Account

The Council Tax Online Account is linked to mygovscot myaccount. Your online account allows you to:

- Instantly access your Council Tax details and bills

- Report changes

- Sign up for paperless billing

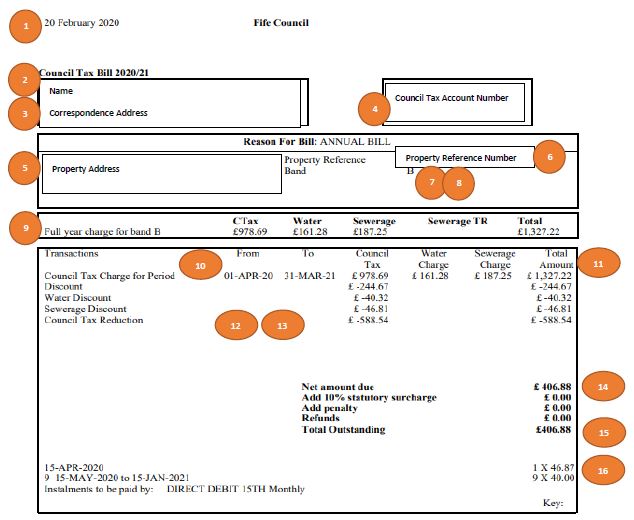

Your online bill explained:

- The date the Council Tax bill was issued

- The person(s) liable/responsible for paying the Council Tax and the property address

- Correspondence address

- Your Council Tax account number

- The property address the Council Tax bill relates to

- The property reference the Council Tax relates to

- Band – the valuation band your property is in

- If you have had your band reduced because you have a disability, you will see your reduced band here

- The annual charge for a property in your valuation band – broken down between Council Tax, water & waste water charges and total

- The period of time the bill covers

- Charges for your bill – broken down between Council Tax, water & waste water charges and total

- If you have a property that has been empty for 12 months or more you may be charged an empty property variation. This charge will be equivalent to your annual council tax charge and will be displayed here

- Any deductions that have been made to this account, up to the date the bill was issued. This includes any discounts, exemptions and income related Council Tax Reduction

- Payments that have been made to this account, up to the date the bill was issued

- This shows the balance payable for this bill

- Payments should be made in accordance with the amounts and instalment dates shown

- General information along with contact details